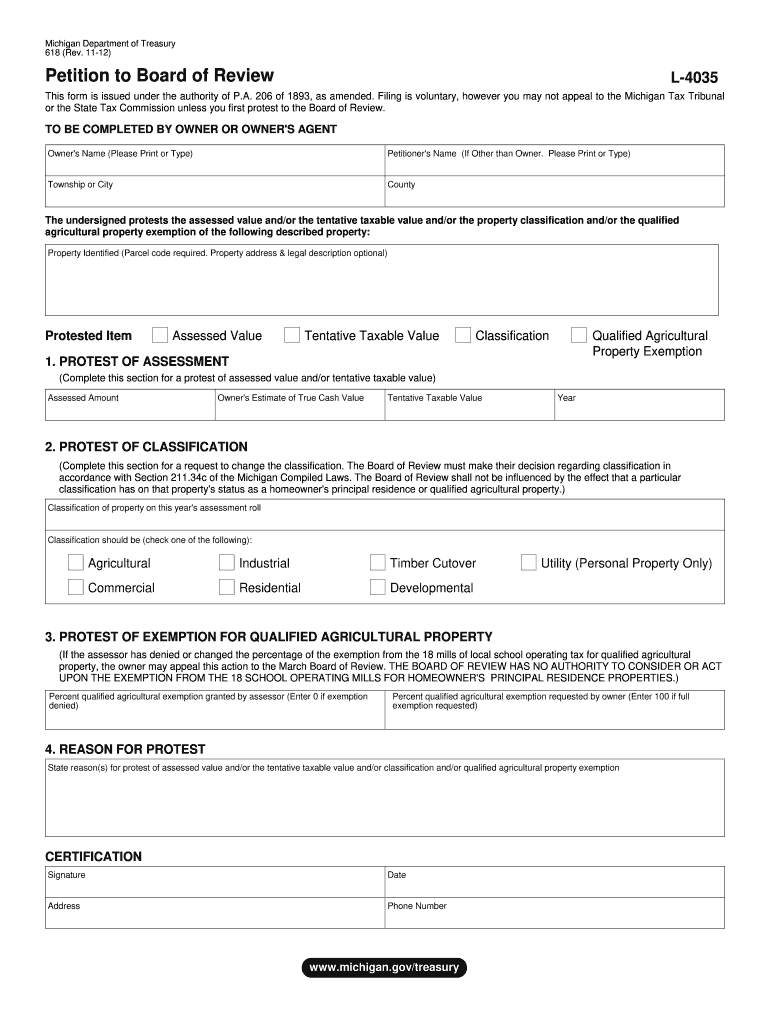

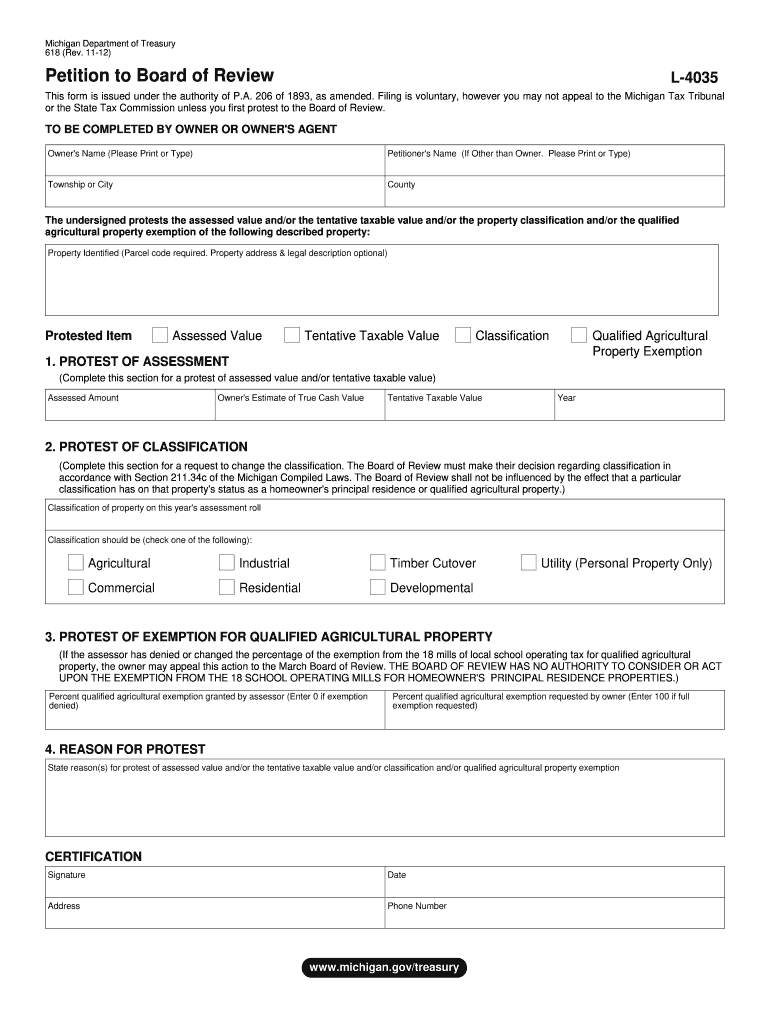

MI 618 L-4035 2012-2024 free printable template

Get, Create, Make and Sign

How to edit michigan form l 4035 online

How to fill out michigan form l 4035

How to fill out Michigan Form L 4035:

Who needs Michigan Form L 4035:

Video instructions and help with filling out and completing michigan form l 4035

Instructions and Help about petition 4035 form

Built in the USA the 2014 Chevrolet sonic is the second smallest car to wear the Bowie batch, but its abilities are far from diminutive the sonic delivers fuel economy that's equal to or better than its rivals and driving dynamics that range from comfortable and nimble to downright 40 the sonic is no ordinary small car it offers loads of great standard features such as Bluetooth air-conditioning and audio controls on the steering wheel the marlin infotainment system that allows for control of cell phone enabled apps is available and LT model and standard on LTD and rs new for 2014 a rear vision camera is available on the LD and comes standard on the LTC and RS models plus you can get an available advanced safety package with lane departure warning and forward collision alert further the lieutenant promotional package includes Radio and front fog lights around town and on the highway the 2014 Chevy sonic set the new standard for subcompact driving refinement as it drives more like a bigger pricier car than any of its competitors one of the front-wheel drive Sonic's best tricks is how it manages to deliver both segment-leading highway matters with impressive road holding abilities inside the 2014 Chevy Sonic is a mix of conservative design with a touch of motorcycle inspiration in the form of the combat gauge cluster with a digital speedometer in addition check out the sporty or aesthetic is stiffer suspension leather seats and unique 17-inch wheels the 2014 Chevy Sonic is the quietest and most composed subcompact car you can buy combined with more conventional styling and service key competitors the solid is destined to become a mass-market favorite

Fill board 4035 : Try Risk Free

People Also Ask about michigan form l 4035

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your michigan form l 4035 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.